California Minimum Salary Threshold 2024

California Minimum Salary Threshold 2024. 1, 2024, exempt employees in california must be paid a minimum annual salary of $66,560. As of january 1, 2024, employees in california must earn an annual salary of no less than $66,560 to meet this threshold requirement.

As of january 1, 2024, employees in california must earn an annual salary of no less than $66,560 to meet this threshold requirement. Pennsylvania’s minimum living wage is $57,664, which is almost $9,000 more than the average starting teacher salary (49,803).

In Addition, The Rule Will Adjust The Threshold For Highly Compensated Employees.

Living wage ordinances in various locales within the state have been enacted, so local standards should be confirmed to ensure compliance with all governing wage requirements.

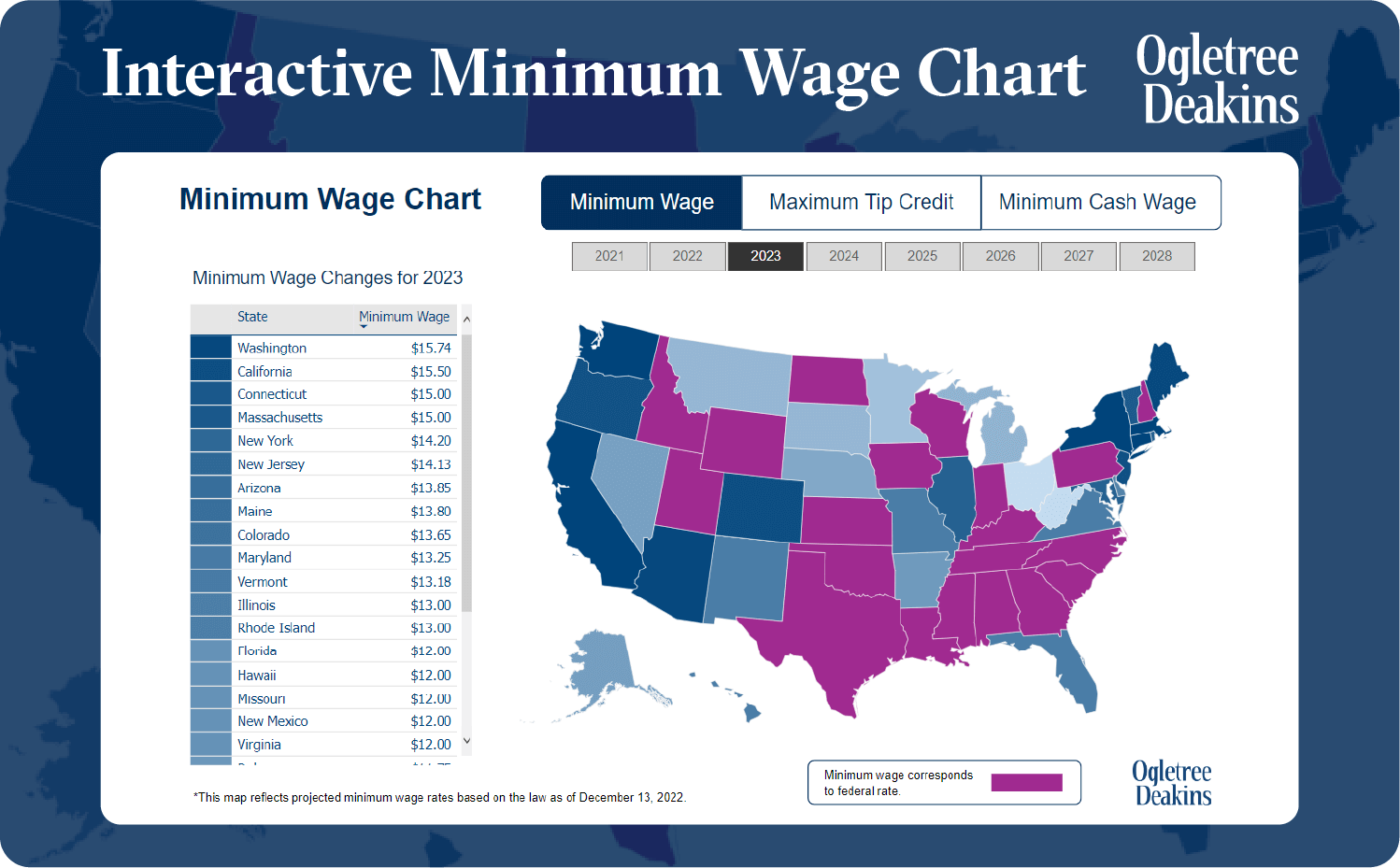

As Of 2023, California’s Minimum Wage Currently Stands At $15.50 Per Hour For All Employers, With Some Cities And Counties Adopting A Higher Minimum Wage.

As of 2024, the california minimum wage is $16.00 an hour.

New Jersey’s Minimum Living Wage Is $73,517, A Whopping $17,083.

Images References :

Source: www.govdocs.com

Source: www.govdocs.com

California Minimum Wage in 2024 GovDocs, Flsa exemption salary threshold 2024 poster now. Effective january 1, 2024, the minimum wage is $16.00 per hour for all employers.

Source: francenewlesly.pages.dev

Source: francenewlesly.pages.dev

Minimum Wage Laws California 2024 Jorie Malinda, On april 23, the department of labor (dol) issued its final rule to alter the overtime pay regulations under the flsa. Effective january 1, 2024, the minimum wage is $16.00 per hour for all employers.

Source: neswblogs.com

Source: neswblogs.com

Whats The Minimum Wage In California 2022 Latest News Update, This rate is not static and is subject to changes as dictated by the state’s labor laws. Employers must post the minimum wage order and the wage order applicable to their workplace at a worksite area accessible to employees.

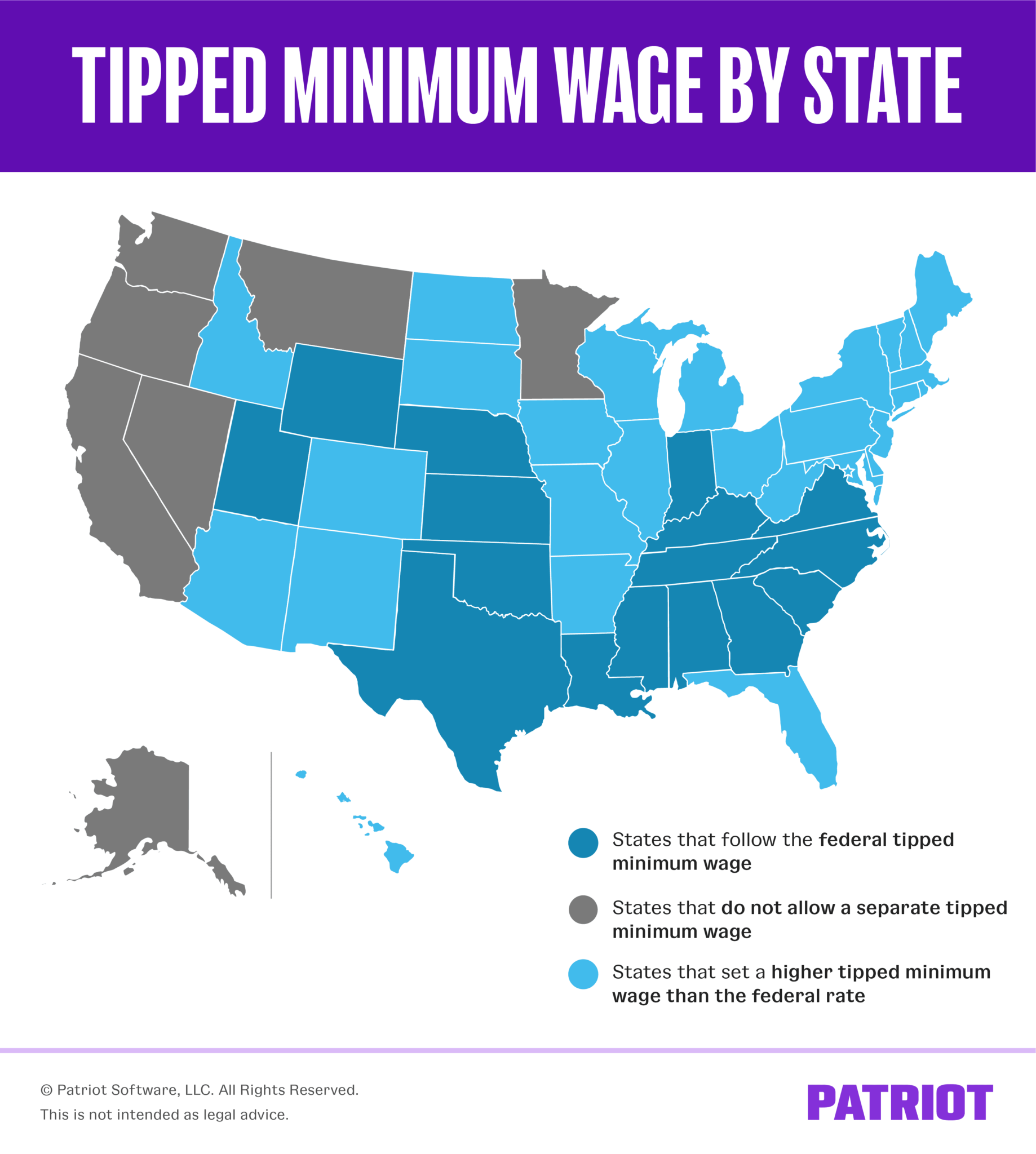

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Tipped Minimum Wage Federal Rate and Rates by State (2024), 1, 2025, the rule’s new methodology takes effect, resulting in the additional increase. 1, 2024, up from the current $15.50 hourly rate.

Source: www.wageandhourdevelopment.com

Source: www.wageandhourdevelopment.com

California Minimum Wage Requirements Effective January 1, 2023 Wage, Jerry brown signed a law that ratcheted up the pay floor from $10.50 in 2017. Pennsylvania’s minimum living wage is $57,664, which is almost $9,000 more than the average starting teacher salary (49,803).

Source: signalduo.com

Source: signalduo.com

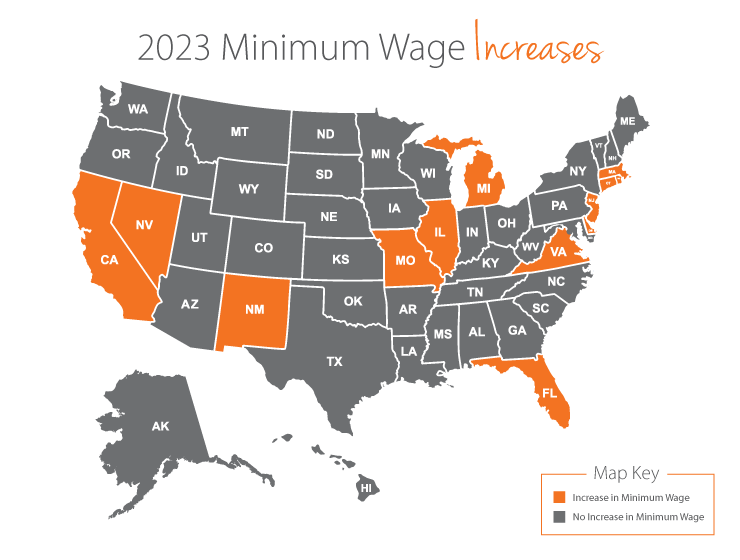

Top 10 minimum wage by state 2022 2022, Employers also must keep in mind that some cities and counties in california have adopted their own local minimum wage rates that are separate from the state rate. On april 23, the department of labor (dol) issued its final rule to alter the overtime pay regulations under the flsa.

Source: neswblogs.com

Source: neswblogs.com

Minimum Wage California 2022 Annual Salary Latest News Update, In 2023, the minimum salary for exempt employees in california is $64,480.00 per year. Effective january 1, 2024, the minimum wage is $16.00 per hour for all employers.

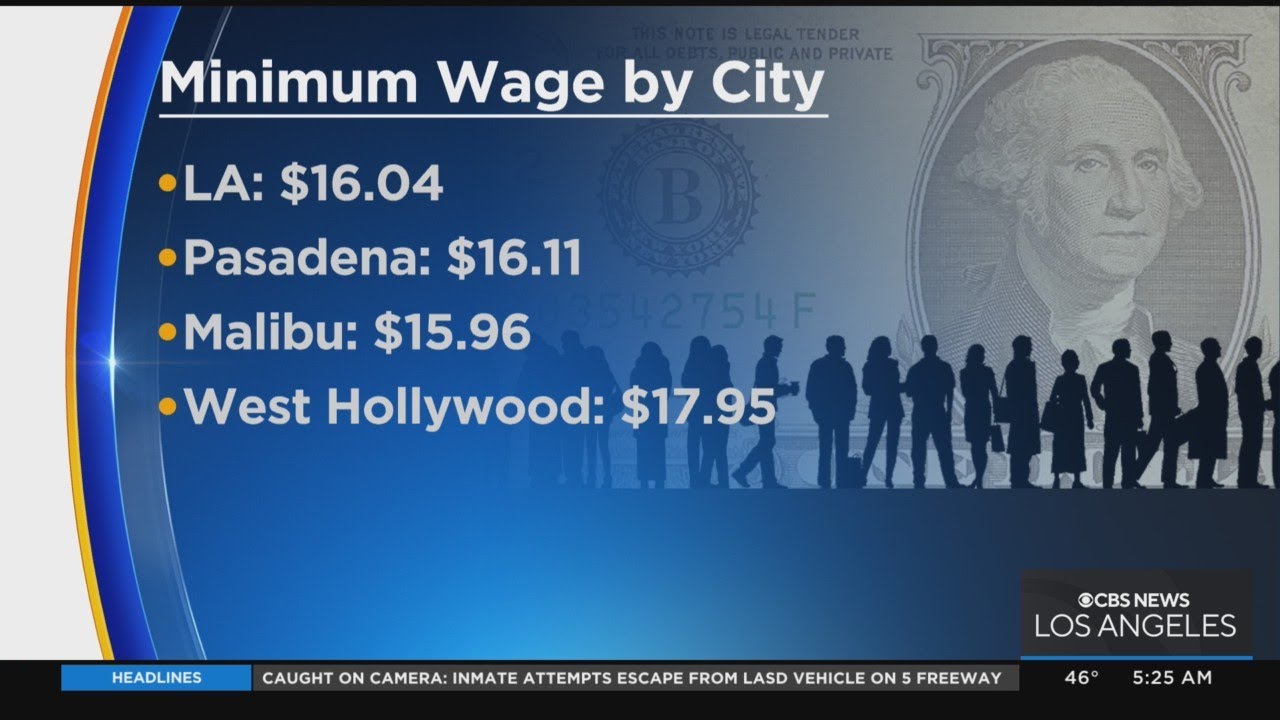

Source: www.youtube.com

Source: www.youtube.com

California minimum wage increase takes effect this week YouTube, New york's minimum living wage is $69,433, a whopping $20,118 jump from the state's average teacher starting salary ($49,315). California’s minimum wage will increase to $16 per hour for all employers on jan.

Source: nakaselawfirm.com

Source: nakaselawfirm.com

California Minimum Salary Nakase Law Firm, California minimum wage set to increase jan. Employers must post the minimum wage order and the wage order applicable to their workplace at a worksite area accessible to employees.

Source: northgatesentinel.com

Source: northgatesentinel.com

The Sentinel California Minimum Wage Increases to Bridge the Gap of, The minimum wage in california, effective january 1, 2024, is $16.00/hour for all employers. What is the minimum wage in california?

Effective January 1, 2024, The Minimum Wage Is $16.00 Per Hour For All Employers.

Effective january 1, 2024, the california state minimum wage is $16.00 per hour.

New York's Minimum Living Wage Is $69,433, A Whopping $20,118 Jump From The State's Average Teacher Starting Salary ($49,315).

1, 2025, the rule’s new methodology takes effect, resulting in the additional increase.